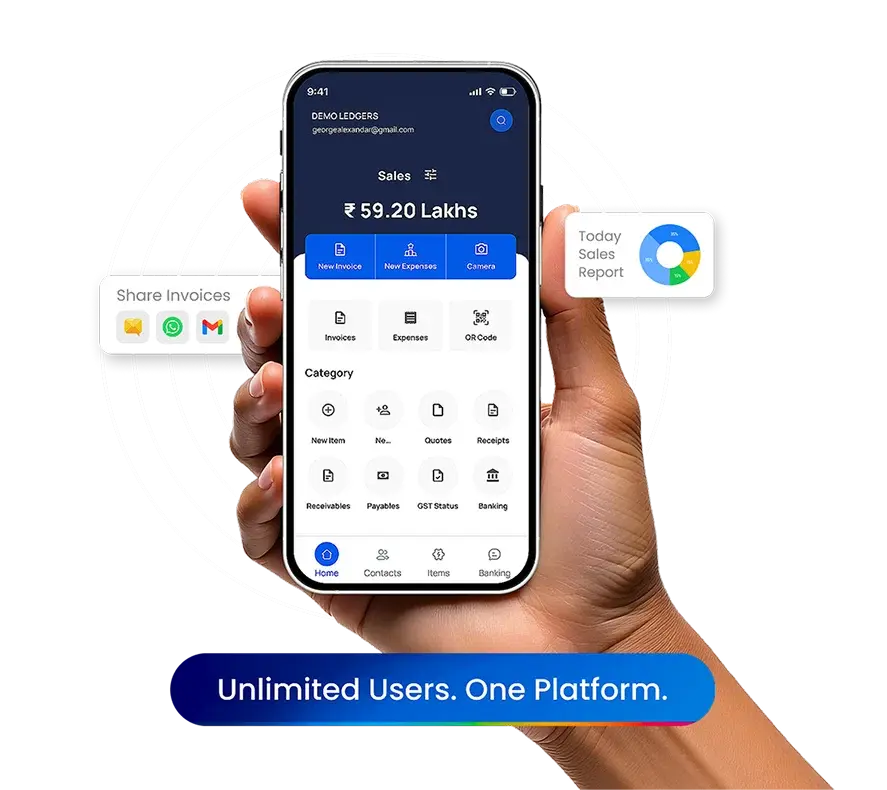

Setup LEDGERS

Auto ITC Sync

Sync ITC data directly from GST portal for accurate reconciliation.

Export Reports

Download ITC summary and reconciliation reports in Excel format.

Visual Metrics

View ITC received, receivable, mismatches, defaults, and reconciled in one dashboard.

How ITC Reconciliation Works

-

Sync ITC Data

Fetch your GSTR-2B data from GSTN and import purchase records from your books.

-

Reconcile & Review

Match ITC received (GSTR-2B) with ITC receivable (your records). Identify mismatches and defaults.

-

Export & Take Action

Download detailed monthly or yearly reports for audit, compliance, or further action.

ITC Metrics & Dashboard

-

ITC Received

Credit as per GSTR-2B data from GSTN.

-

ITC Receivable

Purchases recorded in your books.

-

Mismatch & Default

Identify invoices with mismatches or not matched with GSTR-2B.

-

Reconciled

Invoices successfully matched and reconciled.

-

Stay Compliant

Avoid penalties and ensure timely, accurate ITC claims.

-

Faster Reconciliation

Automated matching and clear dashboard for quick review.

-

Audit Ready

Export detailed reports for internal and external audits.